.png)

.png)

You’re previewing our new site homepage

.png)

Enabled by pipeline connectivity build out, U.S. refiners are investing to run more light domestic crudes while also having the ability to take as much Canadian heavy sour crudes as possible.

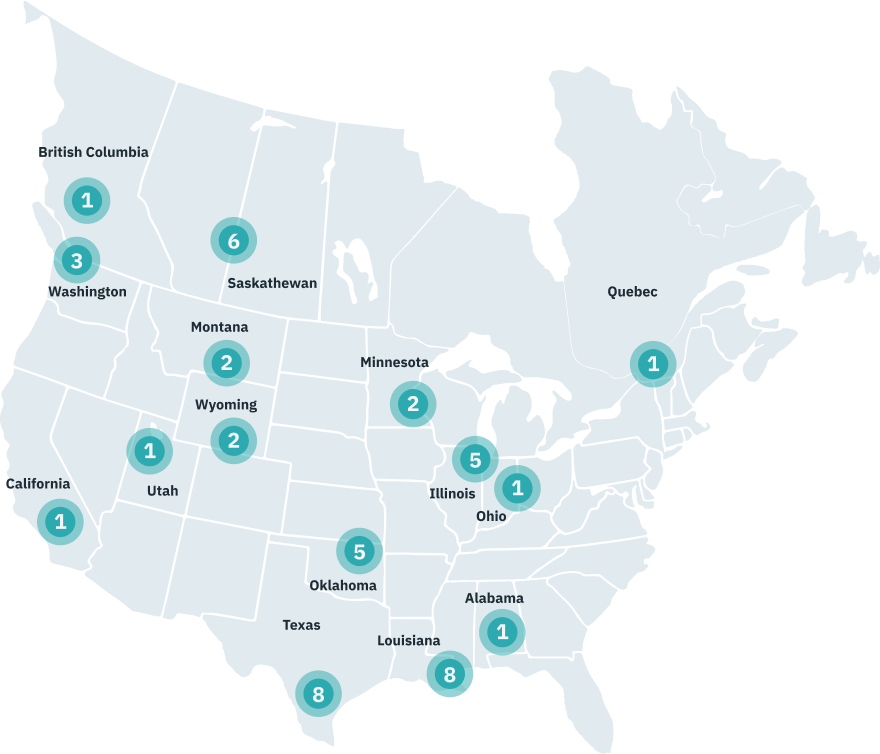

Since 2020, 7.858 million bpd of crude pipeline capacity has been commissioned, connecting Bakken, Western Canadian, Permian, and South Texas production to refining centers, according to the EIA. This pipeline build out occurred in the U.S. Midcontinent and Gulf Coast (Figure 1), excluding U.S. East Coast and West Coast refiners, where pipeline additions face fierce environmental opposition.

Figure 1: 2021-2023 crude and vacuum unit projects

Source: Industrial Information Resources

Without direct pipeline access, East and West Coast refiners source crude by waterborne transit, which is more emissions intensive. In addition, foreign waterborne crudes traveling longer routes to port are more affordable than domestic waterborne shipments due to the Jones Act, which requires expensive U.S. flagged vessels to move supply between U.S. ports.

As a result, refineries with pipeline access have an advantage over refineries that rely on foreign waterborne supply, in terms of access to lower carbon intensity supply given lower transportation-related emissions.

The White House has, from time to time, considered limiting crude oil imports and exports in an effort to control prices. The ability to consume domestic crudes with direct pipeline access is a clear advantage should this type of policy be implemented, leaving non-connected refineries out to dry.

Clean rail transport with electric or renewable fuel-powered locomotives, could potentially be utilized to move low-emissions supply to non-pipeline connected facilities. CN is currently testing these technologies and has net-zero commitments.

While the consolidation of evolving emission quantification and reporting standards is well underway, emission scopes and boundaries remain topics of discussion. Still, those standards recognized as early front runners include emissions related to transportation, suggesting local crude sourcing may offer an emission intensity advantage. As domestic and international buyers strive to achieve publicly stated emission reduction targets, we expect low emission intensity to become a valuable attribute in the near future, in addition to quality attributes such as sulfur content and gravity.

Carbon reduction projects must be guided by facts, using both top-down and bottom-up data.

Validere has the experience and technology to benchmark and reconcile your GHG emissions across different scopes, the first step in identifying and deploying strategic capital towards emission abatement projects with the most impact on your GHG emissions and your bottom line. For more information about how our Carbon Hub solution can help refiners position for the future, contact us at carbonhub@validere.com.

Download the full Validere Insights report to learn more about refining in transition and crude diet flexibility.

Hillary is a subject matter expert on crude oil trends and their impact on the North American crude oil supply chain, with particular expertise in Cushing oil storage, North American refining, and pipeline networks.