.png)

In 2021, the pressure on the oil and gas industry to address carbon emissions continued to mount from all sides: the American Petroleum Institute has called for “sensible regulation that prices carbon across all economic sectors,” a European court has called for Shell to accelerate emissions reductions, and COP26 resulted in 140 countries pledging to achieve net-zero emissions.

Going into 2022, investors and regulators know something has to be done and are expecting change from the energy industry; however, the regulations and the market have not yet matured, leaving uncertainty for oil and gas companies on what to do.

The only certainty in this story is that carbon intensity will need to be measured and mitigated.

Read below for our take on what’s to come or watch our webinar Carbon is the New Sulfur.

The energy transition looks like sulfur

In the 70s and 80s, it was becoming increasingly clear that sulfur was causing environmental and health problems, being the main source of smog and acid rain. It was clear that change was needed.

Sulfur regulations were enacted, creating the incentive and pressure for oil and gas companies to measure and reduce their sulfur content. Once the regulatory incentives became certain, energy companies began to measure sulfur emissions at each step of the process, in the same way they measured any other attribute that affected the price of their commodity, like density or vapor pressure.

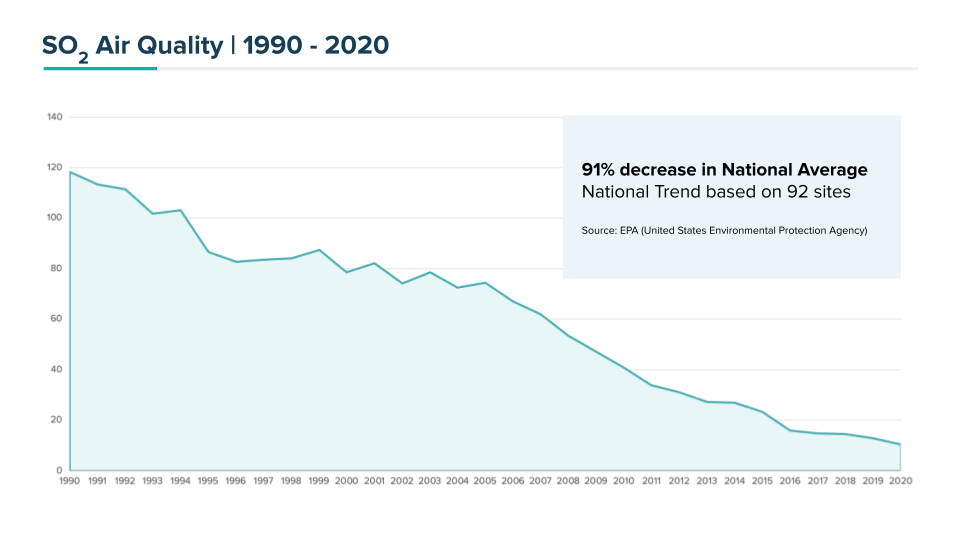

With this full integration of sulfur into the industry, petroleum companies became efficient at measuring sulfur and were able to essentially design its emissions out of existence, leading to SO2 plummeting by 90% within 30 years in the US.

This “virtuous cycle” shows how smart policy can drive innovation and lead to a scalable solution where reduction is greater, and costs lower than anticipated.

Focus on the fundamentals

The first steps are clear: start measuring carbon throughout your company, use that data for forecasting, and integrate your carbon management strategy into your business planning.

Just like sulfur, carbon intensity will eventually become a measured attribute through the whole production process. However, it is not clear yet on how carbon regulations and the market incentives will shake out. This is why it is important to have the carbon data and data management in place, so you can quickly make decisions and pivot.

“It is key that you are measuring your emissions and understanding the levers you can pull”

Measurement and reporting does not have to be onerous

Just like with sulfur, it was unknown what the playbook would be to reduce emissions. What we do know at this point is that having our data in order is the critical first step. For most, current numbers are (at least in the US) incomplete — they are based on the EPA reporting standard, which is based on emission factors that are not actually measured but are assumptions based on equipment.

New sensor technology can help with knowing your exact numbers, but expensive equipment may not be the best answer. Why commit to large capital expenditures on new instruments when you could get more out of your current equipment using data analytics?

“We need to know the efficacy of our own numbers; there’s no use in buying more equipment if it’s not giving us a better number.”

A clear path to lower emissions

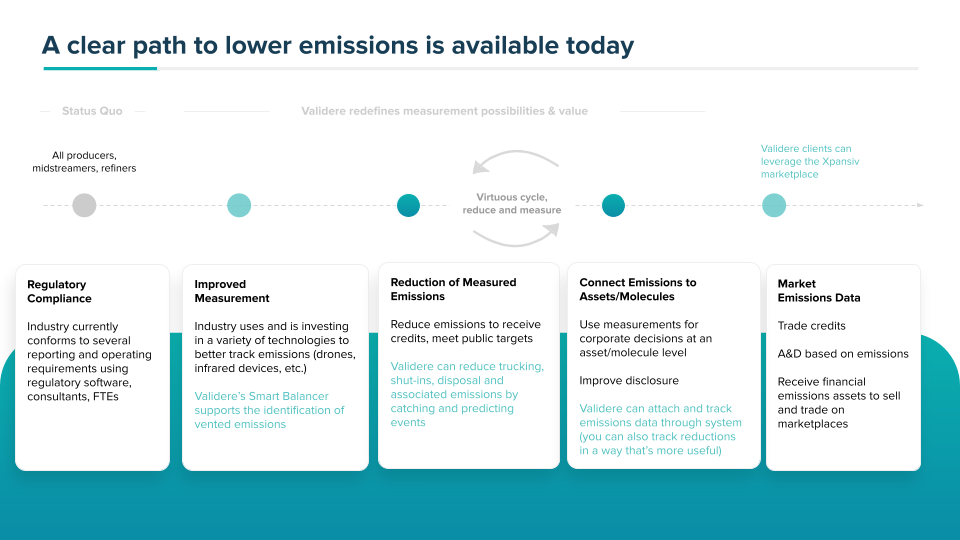

The good news is that everyone is involved with the first step of the process by doing their regulatory reporting annually. The full journey after reporting can be divided into four steps: Improved measurement, reduction of measured emissions, connecting emissions to assets, and finally marketing emissions data.

This path is not perfectly linear. Just like sulfur, there is a virtuous cycle between the reduction of emissions and connecting those emissions to assets. As you start connecting your emissions to your assets, you can quickly identify areas where you need to focus on either improving measurement or reducing emissions.

Want to learn more about how Validere can help lower your emissions? Check out our Carbon Hub.

There are business incentives to drive down carbon

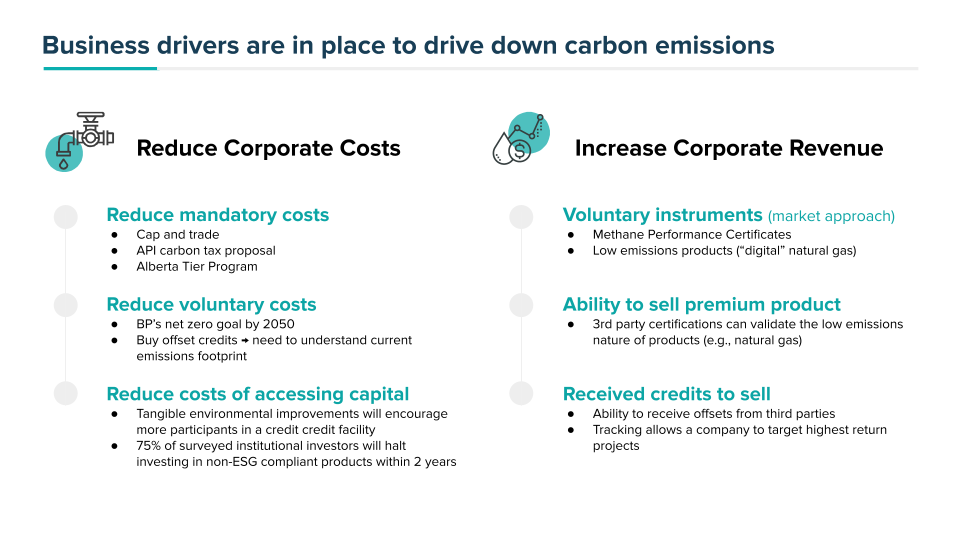

It has never been more true that carbon reduction can lead to positive business outcomes leading to lower corporate costs and higher revenues.

By performing better on emissions, you will incur lower mandatory costs such as carbon taxes, lower the amount of offsets you need to buy to hit corporate targets, and have easier access to capital as investors are looking for lower emission companies and projects to fund.

Opportunities will also be available to generate revenue in the market by selling a premium “ESG product” that can receive higher value, or generating certificates that you can trade.

Want to learn more about certified natural gas? Check out our recent webinar and article on the topic.

Lower your company’s carbon emissions

Want to learn more about carbon emissions reduction? Watch our webinar Carbon is the New Sulfur.

In this webinar, Craig Webster, Managing Director of ESG at Tudor, Pickering, Holt & Co. and Ian Burgess, President & Co-Founder at Validere, go into more detail about how carbon emissions reduction should be modeled after the sulfur reduction movement of the 90’s, and how energy companies can integrate and correlate their sources of emissions data to establish a trusted and auditable baseline and start to uncover their largest opportunities for emissions reduction in 90 days or less.

Trevor Cross

Trevor is a Product Marketing Manager at Validere and has a M.Sc in Chemistry from the University of British Columbia. He has previous experience in chemical research with a particular interest in leading technologies for the energy transition.